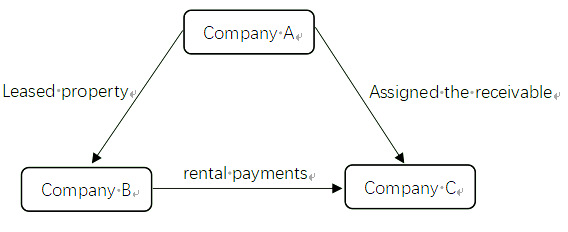

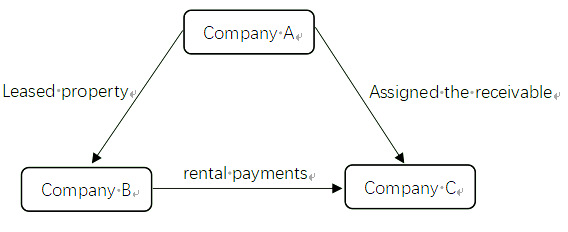

Company A, a real estate enterprise, leased an office property to Company B for office use under a five-year lease term. With two years remaining on the lease, Company A assigned the receivable rental payments to Company C and duly notified Company B of the assignment. Thereafter, Company B directly remitted rental payments to Company C.

By Xueying Chen

Company A, a real estate enterprise, leased an office property to Company B for office use under a five-year lease term. With two years remaining on the lease, Company A assigned the receivable rental payments to Company C and duly notified Company B of the assignment. Thereafter, Company B directly remitted rental payments to Company C.

Question: after the assignment of the rental receivable, who should issue the rental invoice to Company B for the assigned portion of the rental receivable?

Analysis:

In modern economic activities, the assignment of receivables is a common transaction among market participants. However, such assignments often involve at least three parties and extend beyond the mere transfer of contractual or civil rights and obligations. They may also raise issues such as whether the invoicing obligation under the original contract remains with the assignor or shifts to the assignee.

I. Issuing Invoices Requires Actual Business Transaction

The fundamental premise for issuing invoices is the occurrence of actual business transactions, such as the sale of goods or the provision of services. If no such transaction occurs, issuing an invoice is strictly prohibited, as it poses a risk of fraudulent invoicing.

According to Article 18 of the Administrative Measures for Invoices: "Entities and individuals engaged in the sale of goods, provision of services, or other business activities shall issue invoices to the payers upon receiving payments." Article 21, Paragraph 2, further stipulates: "No entity or individual shall engage in the following acts of issuing fraudulent invoices: (1) issuing invoices that do not match actual business transactions, either for oneself or for others; (2) allowing others to issue invoices that do not match actual business transactions; (3) facilitating the issuance of invoices that do not match actual business transactions." Additionally, Article 24 of the Implementation Rules of the Administrative Measures for Invoices provides: "Entities and individuals issuing invoices must do so upon the confirmation of the business revenue generated from actual transactions. No invoice shall be issued if no business transaction has occurred."

The assignment of a receivable is essentially a financial transaction and does not alter or disrupt the underlying transaction. The actual business transaction originally occurred between the assignor (Company A) and the debtor (Company B). Even after the assignment, the transaction remains completed or substantially completed, meaning there is no new transaction between the assignee (Company C) and the original debtor (Company B). Under tax law mentioned above, the entity issuing the invoice must be the party that actually sold the goods or provided the services. Changing this statutory obligation could lead to significant violations, such as fraudulent invoicing, which disrupt tax administration.

Judicial practice has affirmed this principle. In Case No. (2022) Lu 04 Min Zhong 1450, the appellate court held: "Under Article 21 of the Law on the Administration of Tax Collection of the People’s Republic of China, tax authorities oversee the issuance, acquisition, and use of invoices. Entities and individuals engaged in business activities must issue and use invoices as required. The obligation to issue an invoice arises upon the receipt of payment in a business transaction. Where a receivable is assigned, and the payee and actual seller of goods or services become inconsistent, the invoice must still be issued based on the actual business transaction. Therefore, an assignee cannot issue an invoice if it was not the entity originally engaged in the transaction."

Similarly, in Case No. (2022) Zhe 02 Min Zhong 5099, the trial court held: "The obligation to issue VAT special invoices is a statutory duty of the seller. Although the original seller, Ningbo Haishu Jingrui Numbering Machine Co., Ltd., had been deregistered, its shareholder Mingxing Jin inherited the company's receivables and obligations. While enjoying the right to collect the payment, Mingxing Jin is also obligated to issue a special VAT invoice to Feng Shien Company. As a natural person, Mingxing Jin could not issue VAT special invoices, so the invoice had to be issued under the original company's name."

II. Analysis of the View That the Invoice Obligation Should Transfers Along with the Receivable

Some argue that since the receivable has been assigned, the obligation to issue invoices, being an ancillary contractual obligation, should also be transferred to the assignee. However, this view is flawed.

Under Article 547(1) of the Civil Code of the People’s Republic of China: "When a creditor assigns a receivable, the assignee acquires the ancillary rights associated with the receivable, except for those that are exclusively held by the creditor." Moreover, Article 153 provides: "Civil legal acts that violate mandatory provisions of laws or administrative regulations shall be void." The obligation to issue invoices is an administrative duty imposed by law, therefore cannot be transferred along with contractual rights and obligations. Even if the assignor, assignee, and debtor contractually agree that the assignee will issue the invoices, such an agreement would be invalid as it contravenes mandatory tax laws.

Furthermore, courts have consistently held that in contractual relationships, the seller’s primary obligation is to deliver goods or provide services, while the buyer’s primary obligation is to make payment. The obligation to issue invoices is merely an ancillary duty and does not correspond directly to the obligation to pay. Thus, even if the assignee is unable to issue invoices due to tax law restrictions, it still retains the right to demand payment from the debtor.

Conclusion

In cases involving the assignment of receivables, the invoice issuer generally remains unchanged, the obligation to issue invoices does not transfer with the primary contractual rights and obligations.